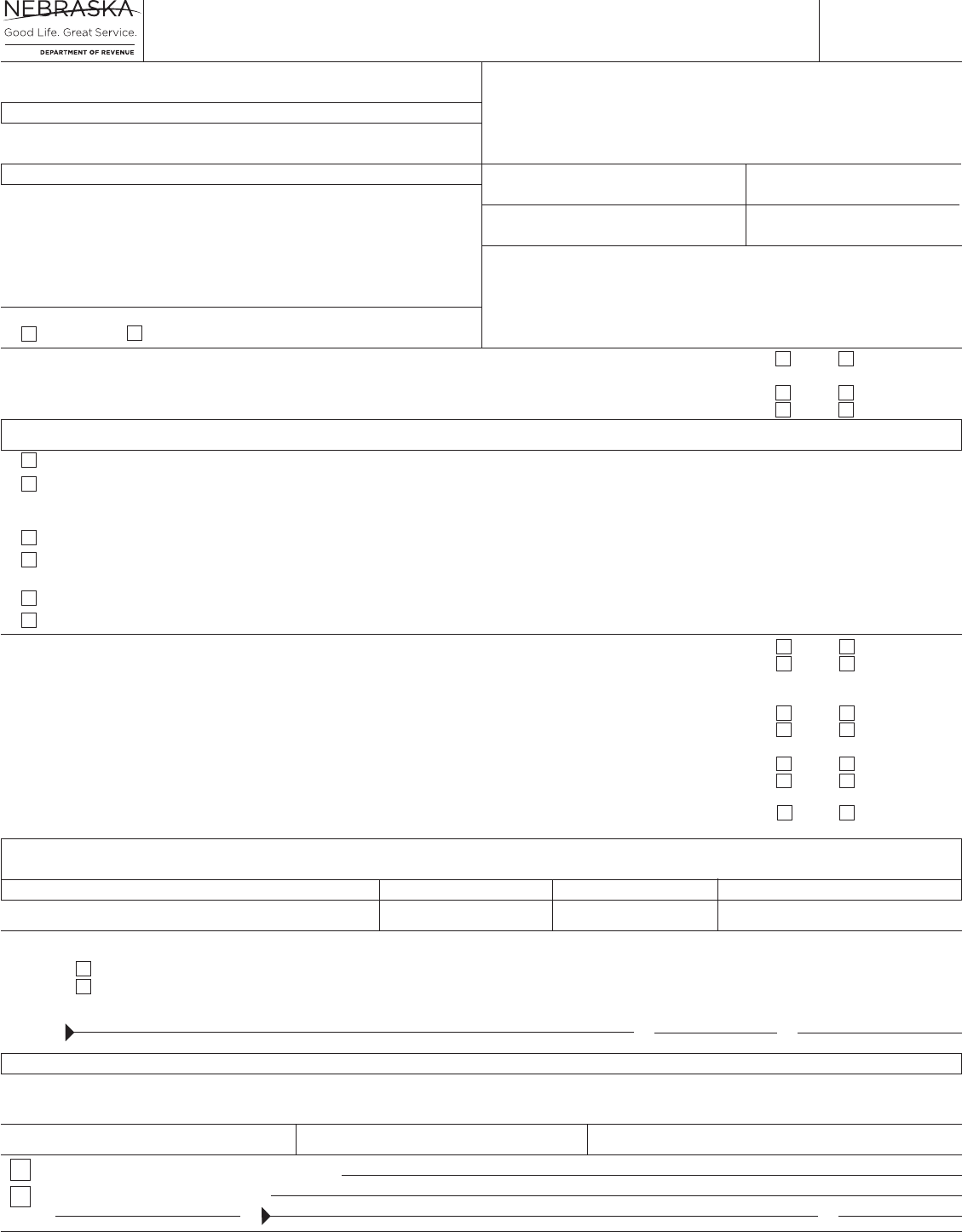

1 Do you currently own this residence?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . YES NO

2 Do you currently occupy this residence? ................................................................. YES NO

3 If applicant is currently residing in a nursing home, please answer these questions:

• What date did you enter the nursing home? _____/_____/_______ (Mo/Day/Yr) or spouse _____/_____/_______ (Mo/Day/Yr)

• Have the household furnishings been removed from your residence? ........................................ YES NO

• Is the residence currently being leased or rented by another person? ........................................ YES NO

• If Yes, who is residing in the residence? ______________________________________________________________

4 Is this homestead owned by a trust? .................................................................... YES NO

• If Yes, are you residing at this homestead as a beneficiary under the trust instrument per Neb. Rev. Stat. § 77-3503? ... YES NO

5 If you received a homestead exemption last year, is the preprinted information on this form complete and correct (names,

Social Security numbers, birth dates, filing status, exemption category, other owner-occupants, etc.)? ................. YES NO

• If No, please indicate the correct information in the appropriate area.

FORM 458

2022

Nebraska Homestead Exemption Application

• Nebraska Schedule I – Income Statement must be filed with this form except for categories 4 and 5.

• Application for Transfer must be filed by August 15 if moving to a new homestead.

Please Do Not Write In This Space

Applicant’s Name and Mailing Address

File with your county assessor after February 1 and on or before June 30.

Must File Annually For Exemption

1 Did you become widowed between January 1, 2021 – December 31, 2021? ..................................... YES NO

1a If Yes, what is your spouse’s date of death? _____/_____/_______ .

2 Does one of your parents, children, or siblings own and occupy this homestead? ................................. YES NO

3 Were you legally married as of December 31, 2021? ....................................................... YES NO

Homestead Exemption Categories

• Nebraska Schedule I must be filed for all categories except Numbers 4 and 5. • See instructions on reverse side for specific requirements.

1 Qualified owner-occupants age 65 and over as of January 1 of application year.

2 Veterans totally disabled by a nonservice-connected accident or illness ( Form 458B or VA certification required; see instructions).

Veteran’s Service Dates Beginning ______________________________ , __________ and Ending ______________________________ , __________

(Month) (Day) (Year) (Month) (Day) (Year)

3 Qualified disabled individuals (Form 458B certification required; see restrictions and instructions for certification requirement).

4 Veterans drawing compensation from the Department of Veterans Affairs because of 100% service-connected disability, or unremarried surviving spouse.

(VA certification required; see instructions for certification requirement).

5 Paraplegic veteran or multiple amputee whose home value was substantially contributed to by the Dept. of Veterans Affairs (VA certification required; see instr.)

6 Individuals who have a developmental disability certified by the Department of Health and Human Services (Form 458B is required; see instructions).

Others (excluding a spouse) Who Both Own and Occupy The Residence (Attach list if necessary.)

• Nebraska Schedule I — Income Statement must be filed for each owner-occupant (DO NOT repeat applicant and spouse.)

Name Relationship to Applicant Date of Birth (Mo/Day/Yr) Social Security Number

Under penalties of law, I declare that I have examined this form and that it is, to the best of my knowledge and belief, true and correct. I also declare that I am entitled

to the Nebraska homestead exemption and have not applied for a homestead exemption elsewhere in the state.

I am a citizen of the United States.

I am a qualified alien under the Federal Immigration and Nationality Act. My immigration status and alien number are

as follows: ____________________________ and I agree to provide a copy of my USCIS documentation uponrequest.

sign

here

Signature of Applicant (required) Date Phone Number (required)

For County Assessor’s Use Only

Legal description of homestead or physical description of mobile home:

Parcel or Location ID Number Tax District Number Current Assessed Value of the Homestead Property

Date Received by County Assessor

Signature of County Assessor Date

County Approved (subject to income

approval by the Department of Revenue)

County Disapproved

Comments:

Nebraska Department of Revenue Authorized by Neb. Rev. Stat. §§ 77-3510 – 3514 and 77-3528

Please Type or Print

/ /

Applicant’s Date of Birth (Mo/Day/Yr) Applicant’s Social Security Number

Spouse’s Date of Birth (Mo/Day/Yr) Spouse’s Social Security Number

Physical address of homestead residence, if different from mailing address.

/ /

/ /

County

Filing Status (see instructions for filing status requirements)

Single Married or Closely-Related

File with your county assessor after February 1 and on or before June 30.

Retain a copy for your records.

Form No. 96-295-2009 Rev. 3-2022

Supersedes 96-295-2009 Rev. 1-2022

RESET

PRINT

Who May File. Any individual qualifying under one of the categories listed below who, on January 1, is an owner-occupant of a residence used as

his or her primary home, including every person who has previously been granted a homestead exemption may le a Form 458. An owner-occupant

means: (1) the owner of record or surviving spouse (current year only); (2) the occupant purchasing and in possession of a homestead under a land

contract; (3) one of the joint tenants, or tenants in common; or (4) the beneciary of a trust that has an ownership interest in the homestead (see Neb.

Rev. Stat. § 77-3503).

A homestead exemption is available to U.S. citizens or qualied aliens. Check the applicable box and indicate your alien registration number if you

are a qualied alien. The Nebraska Homestead Exemption Information Guide is available at revenue.nebraska.gov/PAD/homestead-exemption.

When and Where to File. This form must be completed in its entirety, signed, and led after February 1 and on or before June 30 with your county

assessor. It is the applicant’s responsibility to secure the necessary application forms. Failure to timely le is a waiver of the homestead exemption.

Late Filings. An applicant may le a late application no later than June 30, 2023 pursuant to Neb. Rev. Stat. 77-3514.01 if: 1) applicant includes

a copy of the death certicate of a spouse who died during 2022 or 2) applicant includes a signed Physician’s Certication for Late Homestead

Exemption Filing, Form 458L verifying applicant was not able to timely le due to a medical condition.

Filing Status. Filing status information is required to determine the income limits used to calculate the percentage of relief, if any. The ling status

may be either be “Single, Married or Closely-Related.”

• Use the “Single” status if the homestead applicant led a 2021 federal individual income tax return as “single” or “head of household” or would

have led as “single” or “head of household”, if required to le a 2021 return.

• Use the “Married” status if the homestead applicant led a 2021 federal individual income tax return as “married, ling jointly” or “married,ling

separately” or would have led using “married, ling jointly” or “married, ling separately”, if required to le a 2021 return.

• Use the married ling status if you have not remarried in the year of your spouse’s death and will be ling a joint return for the year in which

your spouse died.

• Use the “Closely-Related” status if the homestead applicant would have led a 2021 federal individual income tax return as “single” or “head

of household”, but lives with a brother, sister, parent, or child who is also an owner-occupant of the homestead. “Closely-Related” applicants

are subject to the same income criteria as “married” applicants.

Ownership and Occupancy Requirements. The person claiming a homestead exemption must own and occupy the residence (or mobile home)

from January 1 through August 15 of the application year. If not owned and occupied during this time period, the homestead exemption will be

disallowed for the entire year. If you move from one homestead in Nebraska to a new homestead in Nebraska that is acquired between January 1 and

August 15 of the year for which the transfer is requested, contact your county assessor as soon as possible; an Application for Transfer, Form458T, must

be led by August 15. An applicant in a nursing home may qualify for a homestead exemption if: (1) he or she intends to return to the residence; (2)

the household furnishings have not been removed; and (3) the home has not been rented or leased.

Income Requirement. A Nebraska Schedule I – Income Statement must be attached, except when exemption category 4 or 5 is claimed. See

Nebraska Schedule I instructions for income denition and levels. Failure to le the Nebraska Schedule I is a waiver of the homesteadexemption.

Homestead Exemption Categories. Persons in the following categories may be considered for a homestead exemption:

(1) Individuals who are 65 years of age or older before January 1 of the year for which application is made are eligible. The Nebraska ScheduleI –

Income Statement must be led each year.

(2) Veterans who served on active duty during a recognized war of the U.S. and who are totally disabled by a non-service connected accident

or illness are eligible. For the rst year of ling, a Certication of Disability for Homestead Exemption, Form 458B (available from the county

assessor), or certication from the Department of Veterans Affairs afrming the homeowner’s disability must be attached to the application for

homestead exemption. The Nebraska Schedule I – Income Statement must be led with this form each year.

(3) Qualied Disabled Individuals who have a permanent physical disability and who on or before January 1 of the application year have lost all

mobility that precludes the ability to walk without the use of a mechanical aid or prosthesis, or individuals who have undergone amputation of

both arms above the elbow, or who have a permanent partial disability of both arms in excess of 75% are eligible.

For the rst year of ling, a Certication of Disability for Homestead Exemption, Form 458B (available from the county assessor). The Nebraska

Schedule I – Income Statement must be led each year.

(4) Disabled Veterans are eligible to have the total actual value of a homestead exempt from taxation, if they served on active duty during a

recognized war of the U.S. and are drawing compensation from the Department of Veterans Affairs due to: (a) Was certied on or before

January 1 of the application year 100% service-connected disability; (b) the service-connected death of an active duty servicemember leaving an

unremarried widow(er) of this veteran or a surviving spouse who remarries after age 57; or (c) the death of any veteran who died because of a

service-connected disability leaving an unremarried surviving spouse or a surviving spouse who remarries after age 57.

For the rst year of ling, a Certication from the Department of Veterans Affairs is required. Subsequent ling of a certication is at the

discretion of the county assessor or the Tax Commissioner.

(5) Paraplegic or Multiple Amputee Veterans are eligible to have the total actual value of a homestead substantially contributed to by the

Department of Veterans Affairs exempt from taxation. If one of the following occurred on or before January 1 of the application year (a)

veterans who are paralyzed in both legs and cannot walk without the aid of braces, crutches, canes, or a wheelchair; (b) veterans who have

undergone amputation of both lower extremities or one lower and one upper extremity and cannot walk without the aid of braces, crutches,

canes, a wheelchair, or articial limbs, or both upper extremities; and (c) the unremarried widow(er) of a veteran listed in (a) or (b) above.

For the rst year of ling, a Certication from the Department of Veterans Affairs is required. Subsequent ling at the discretion of the county

assessor or the Tax Commissioner.

(6) Individuals who have been certied on or before January 1 of the application year as having a developmental disability by the Department

of Health and Human Services as dened in section 83-1205 are eligible. For the rst year of ling, a Certication of Disability for Homestead

Exemption, Form 458B (available from the county assessor), is required. The Nebraska ScheduleI– Income Statement must be led each year.

For categories 2 through 6; if the applicant was granted a valid homestead exemption in the previous year and no change in homestead exemption

status occurred, then a new disability certication is not usually required; however, the county assessor or the Tax Commissioner may request a

current certication to verify the disability.

Limitations. The homestead exemption is limited to the residence and one acre of land for all categories. Homesteads under categories 1, 2, 3, and

6 with an assessed value exceeding the statutory maximum value will be reduced or disallowed. A percentage of the maximum exempt value of the

homestead will be determined in accordance with the income tables. See the website (address below), or contact your county assessor for details.

Appeal Procedures. If the application for homestead exemption is rejected by the county assessor, the applicant may request a hearing with the

county board of equalization by ling an appeal with the county clerk. If the application for homestead exemption is rejected by the Tax Commissioner,

the applicant may request a hearing with the Tax Commissioner by ling an appeal. All appeals must be in writing and led within 30 days from receipt

of the rejection notice. A homestead exemption appeal cannot be used to protest property valuations. Protests of property valuations is a separate

process that occurs in June each year. Contact your county assessor for assistance.

For more information contact your local county assessor’s office,

or see revenue.nebraska.gov/PAD, or call 888-475-5101.

Instructions

Instructions for Previous Filers

Carefully review any preprinted information to ensure it is complete and correct. Make any necessary changes or additions to the

form in a legible manner. Answer each of the questions and sign the form. If you have any questions, contact your county assessor.